The Principality of Monaco has long enjoyed an attractive tax system for residents and businesses, with no income tax and low corporation tax. However, as tax standards evolve, taxpayers need to adapt their tax strategy to continue to benefit from the advantages offered by Monegasque legislation.

1. Changes to registration fees

The recent tax reform introduced by Law no. 1.548 of 6 July 2023 mainly concerns registration duties in the Principality. These duties, also known as transfer duties, are taxes levied on the sale of real estate or other valuable assets. It is a tax levied by the State at the time of transfer of ownership or other real rights over a property. Registration fees can be either fixed or proportional. The first category is a flat-rate amount imposed by a government authority when certain transactions or administrative formalities are carried out. This amount does not vary according to the value of the property or transaction concerned, hence the term “fixed”. Proportional duties, on the other hand, are calculated as a percentage of the market value of the property or the amount of the transaction.

The tax reform analysed consists of changes to existing tax laws and regulations with the aim of revising tax rates, broadening the tax base or introducing new tax rules.

In practical terms, this means both an increase in fixed costs and an increase in the percentages applied to the market value or transaction amount on the sale of property or other valuable assets.

2. Concerning changes to fixed fees

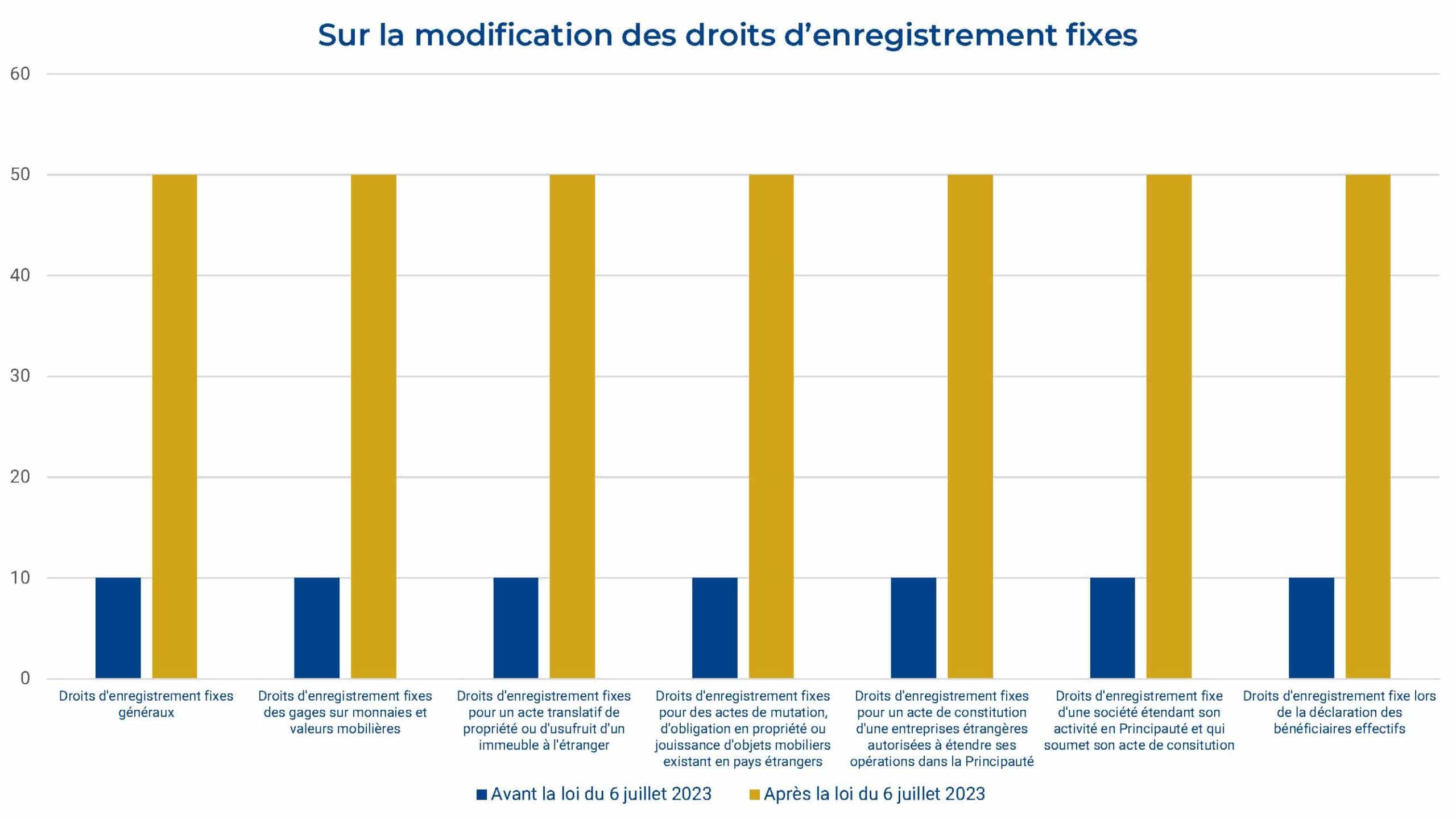

The reform brought about by Law no. 1.548 amends numerous provisions of Monegasque legislation. As a result, all deeds issued after the law of 6 July 2023 for which the fee was initially 10 euros will now be 50 euros. This increase concerns a wide variety of deeds relating to movable or immovable property or resulting from corporate obligations.

In simple terms, any registration of a deed of transfer relating to real estate or its usufruct, held by a Monegasque person and located outside the Principality, is affected by this increase. As far as movable property is concerned, the increase affects pledges of money and securities, transfers and bonds of movable property outside the Principality. Finally, with regard to companies, the same amount will have to be paid when a Monegasque company declares its beneficial owners or when a foreign company applies for authorisation to extend its business in the Principality.

It should be noted that setting registration fees at 50 euros seems to have become the norm, as the text specifies that all fees will be set at this amount unless a text specifically states that this is not the case.

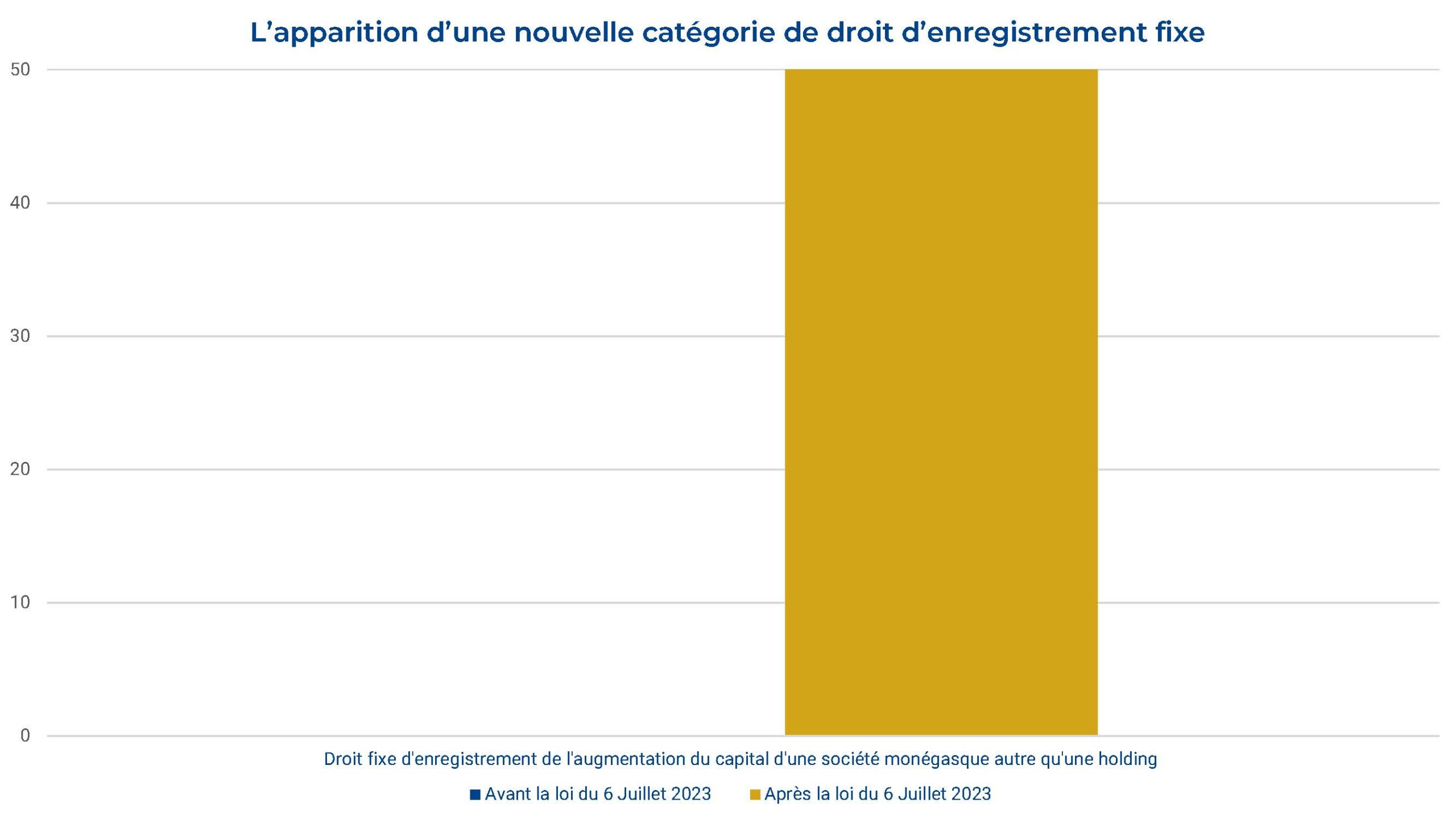

In addition, this law creates a new registration fee which is also set at 50 euros and which applies to deeds relating to an increase in the capital of a Monegasque company.

3. Concerning changes to proportional rights

This second category is also the subject of an increase in the charges relating to certain deeds. The deeds concerned mainly relate to real estate, either because the transaction concerns the property itself or because it concerns a company that owns real estate.

When a company whose purpose is to hold rights in rem over real estate in the Principality wishes to change its beneficial owner, it must pay registration duties to the authorities, which will now be 4.75% of the market value of all the property held. It should be remembered that the term “beneficial owner” refers to the individual or entity that actually has control, ownership or economic benefit of a business, transaction or asset, even though legal or nominal ownership may be held in the name of another entity. It is therefore the party that actually benefits from an activity or transaction, as opposed to the party that is merely designated as the owner on paper. The 4.75% percentage applies under the same conditions when a company wishes to reduce its share capital.

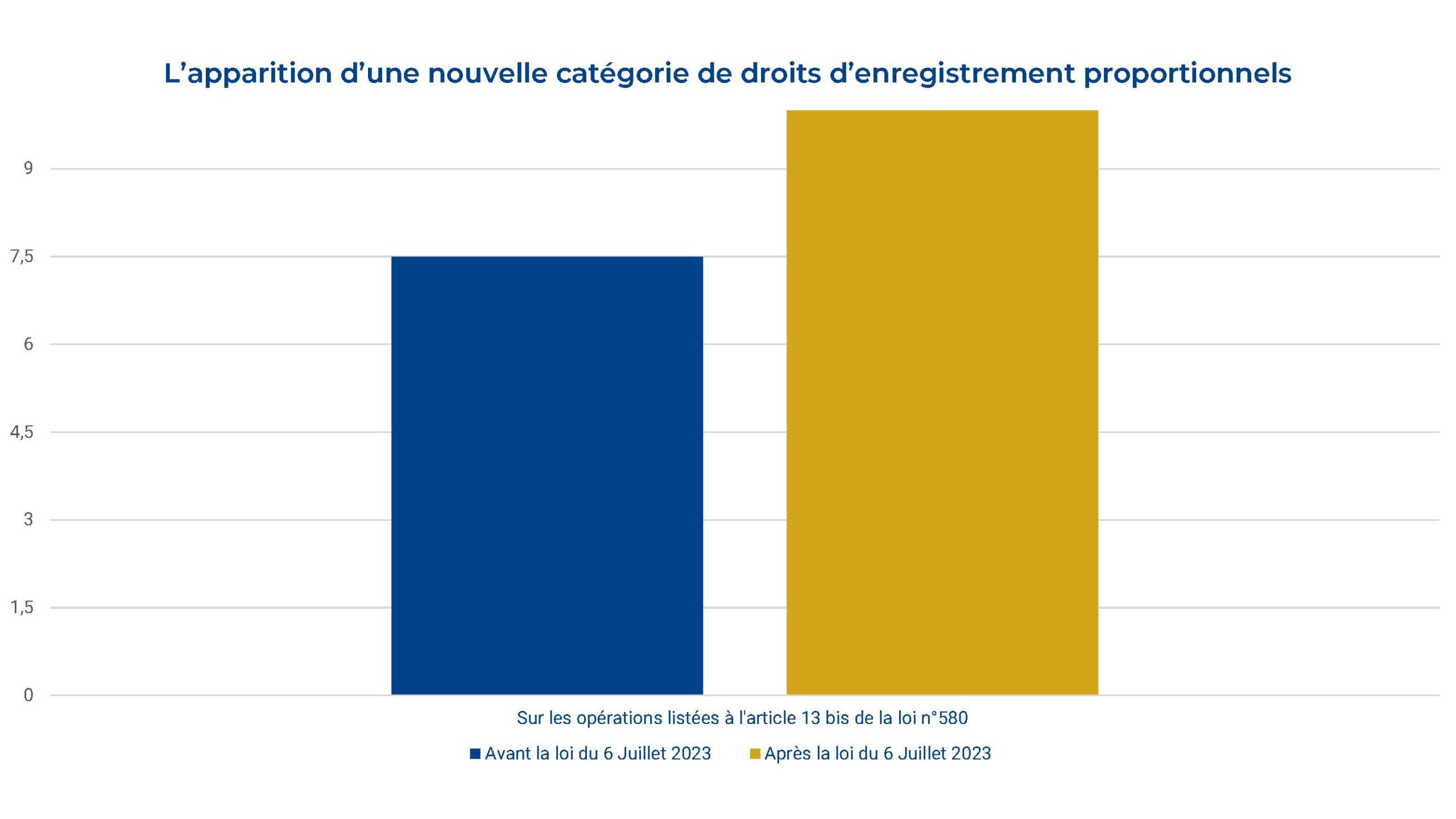

More generally, the percentage applies to a large number of transactions that do not necessarily involve a company. This applies to all the transactions provided for in article 13bis of law no. 580 of 29 July 1953 on the adjustment of registration and mortgage duties. When the transactions listed above are carried out for the benefit of legal entities whose beneficial owners are not directly known to the authorities, these duties are increased to 10% of the total market value of the property or real right concerned.

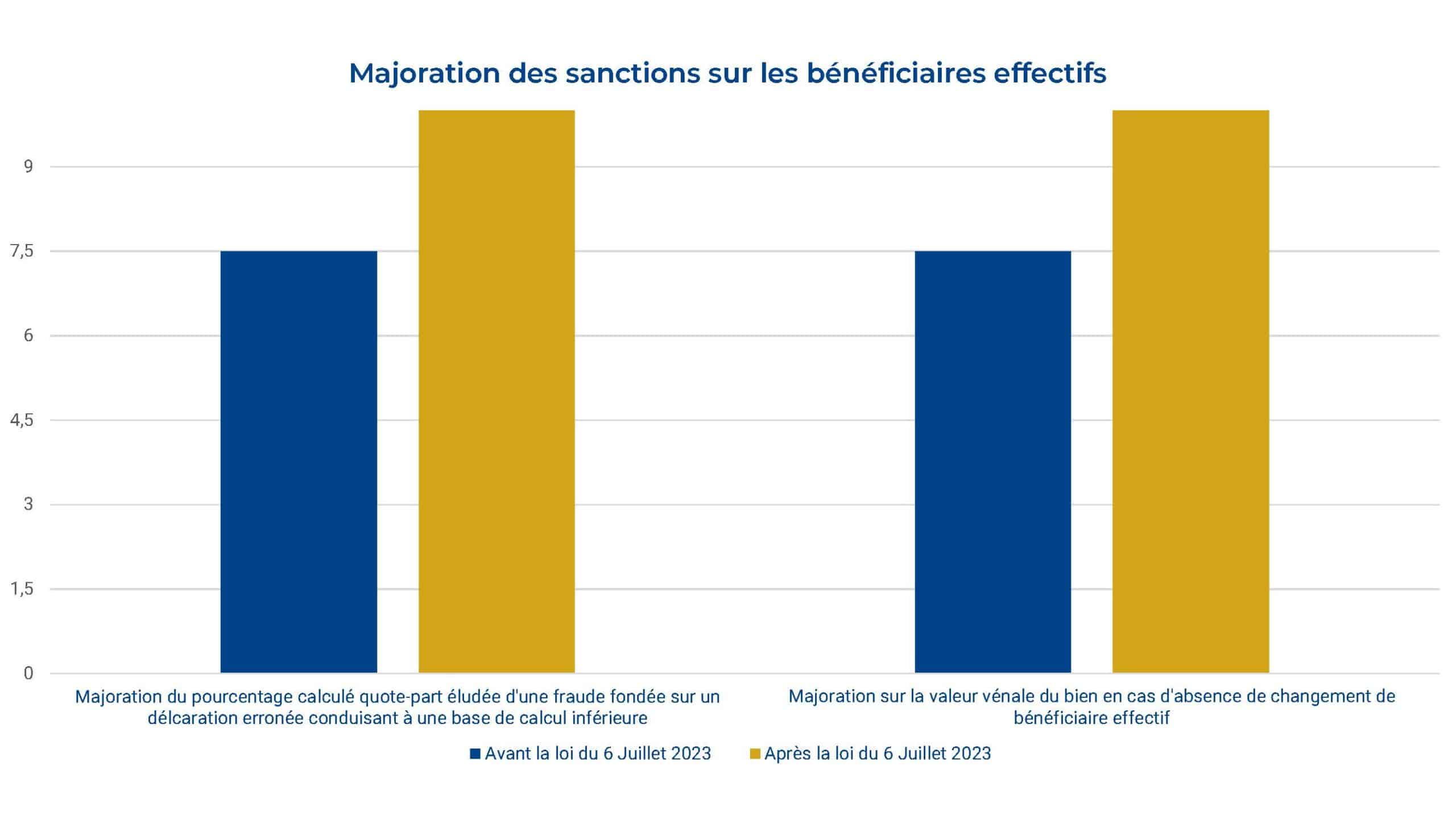

Finally, it should be noted that the law contains a number of marginal provisions aimed at reinforcing the obligation to declare the beneficial owner. As such, in the event of fraud, a surcharge of 10% will be applied to the portion evaded, resulting in a lower basis of assessment. The same will apply if there is no change in the beneficial owner, but this time on the entire market value of the property or real right held.